Confirming a record-breaking summer, the residential real estate market has kept the temperature up with the hottest July in a decade, according to new data on inventory and demand on realtor.com®. Homes for sale in July are moving two percent more quickly than last year as prices continue to hit new record highs.

California again dominated the list with 12 markets, but six other states were represented (Texas, Colorado, Indiana, Ohio, Michigan, and Tennessee).

The median age of properties on realtor.com in July is expected to be 68 days, one day faster than last year but three days slower than last month, a normal seasonal shift. July typically sees inventory age increase as the level of inventory peaks for the year and sales begin to decline.

The median home was listed for $251,000, seven percent higher than one year ago and one percent lower than last month. While that is the first price decrease since January–typical for the seasonal shift–it is a record high for July.

For-sale housing inventory is still growing on a monthly basis, and will soon peak for the year. However, total inventory remains lower than one year ago and the estimated 500,000 new listings expected at the end of the month will once again fail to bring enough relief to buyers looking for the right home.

Jonathan Smoke, chief economist of realtor.com, says:

“The best spring in a decade has transitioned into the decade’s hottest summer. Pent-up demand left over from two years of tight supply against the backdrop of mortgage rates near three year lows have encouraged buyer activity at a time when sales usually begin to decline. While prices are higher as a result of the strong demand and limited supply, the lower mortgage rates are neutralizing the impact on purchasing power.

The confluence of fast-moving inventory and high prices for sellers combined with strong purchasing power for buyers will be hard to repeat in future summers.”

Key Statistics:

· Median age of inventory is estimated to end at 68 days, down two percent from last year and up five percent from last month.

· Median listing price for July should reach a record high of $251,000, a seven percent increase year over year and a one percent decrease month over month.

· Listing inventory in July is expected to show a one percent increase over June. However, inventory should still show a decrease of five percent year over year.

· Realtor.com’s Hottest Markets receive 1.4 to 2.7 times the number of views per listing compared to the national average. In terms of supply, these markets are seeing inventory move 17-37 days more quickly than the rest of the U.S. The hottest markets are seeing inventory movement slow down slightly as the median age increased by two days on average from June.

|

20 Hottest Markets |

July Rank |

July Median Age of Inventory |

June Rank |

June Median Age of Inventory |

|

Vallejo-Fairfield, Calif. |

1 |

36 days |

1 |

34 days |

|

Dallas-Fort Worth-Arlington, TX |

2 |

40 days |

3 |

39 days |

|

Denver-Aurora-Lakewood, Colo. |

3 |

31 days |

7 |

29 days |

|

San Francisco-Oakland-Hayward, Calif. |

4 |

31 days |

2 |

29 days |

|

Stockton-Lodi, Calif. |

5 |

38 days |

4 |

38 days |

|

Columbus, OH |

6 |

44 days |

11 |

44 days |

|

San Diego-Carlsbad, Calif. |

7 |

41 days |

5 |

40 days |

|

Santa Cruz-Watsonville, Calif. |

8 |

42 days |

15 |

40 days |

|

Sacramento–Roseville–Arden-Arcade, Calif. |

9 |

42 days |

8 |

39 days |

|

Santa Rosa, Calif. |

10 |

43 days |

6 |

37 days |

|

Yuba City, Calif. |

11 |

45 days |

New to list |

51 days |

|

Modesto, Calif. |

12 |

39 days |

9 |

40 days |

|

Detroit-Warren-Dearborn, Mich. |

13 |

45 days |

12 |

44 days |

|

Fort Wayne, Ind. |

14 |

47 days |

10 |

44 days |

|

San Jose-Sunnyvale-Santa Clara, Calif. |

15 |

32 days |

13 |

27 days |

|

Colorado Springs, Colo. |

16 |

38 days |

New to list |

37 days |

|

Fresno, Calif. |

17 |

47 days |

New to list |

48 days |

|

Eureka-Arcata-Fortuna, Calif. |

18 |

51 days |

16 |

45 days |

|

Nashville-Davidson–Murfreesboro–Franklin, Tenn. |

19 |

37 days |

New to list |

37 days |

|

Ann Arbor, Mich. |

20 |

47 days |

17 |

41 days |

**Realtor.com reviewed listing views by market as an indicator of demand and median days on market as an indicator of supply. This analysis led to the identification of the 20 hottest medium-sized to large markets in the country.

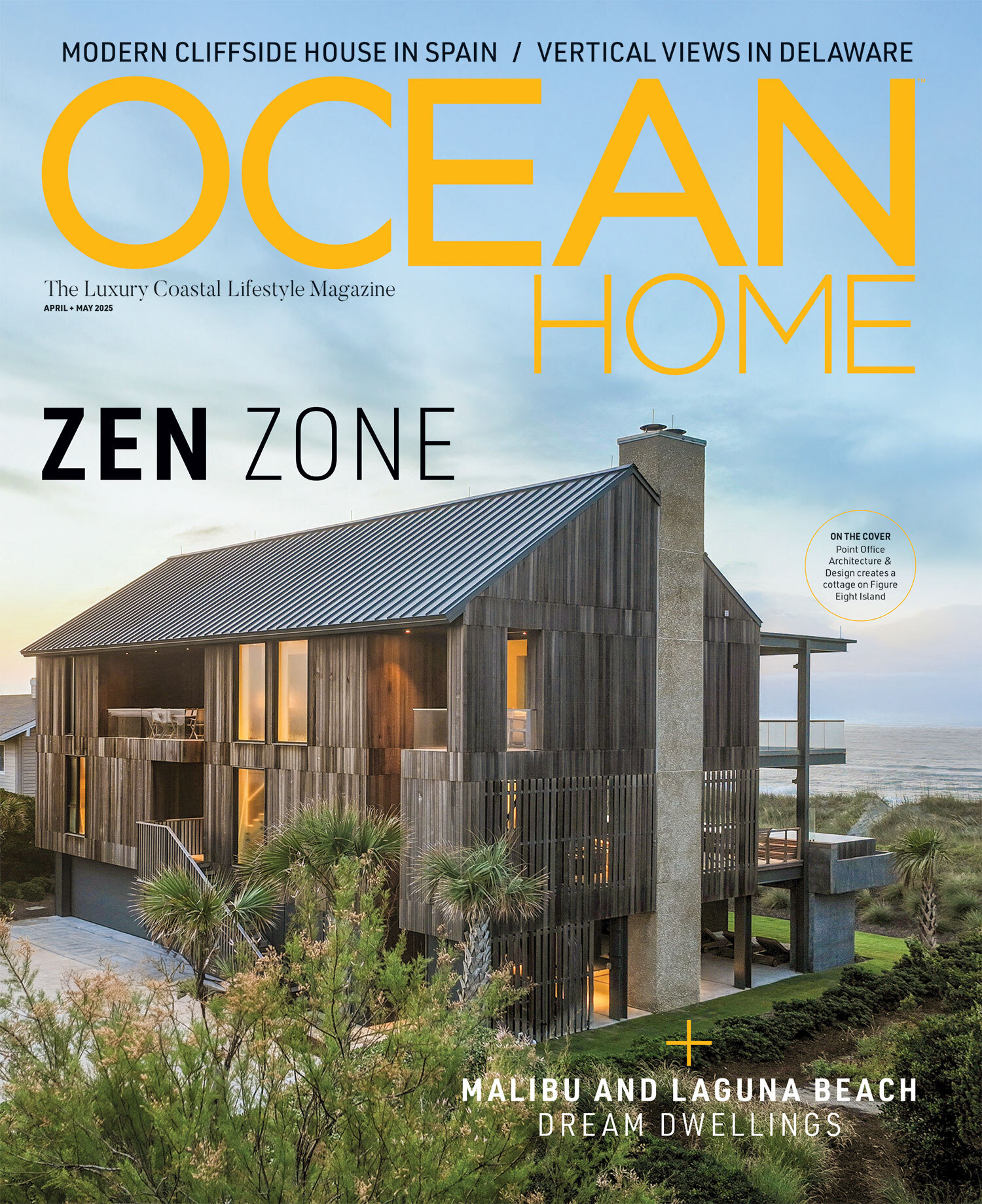

Image Credits: PHOTOS BY AARON LEITZ/COURTESY OF COLDWELL BANKER HOMES.